SHARE OWNERSHIP GUIDELINES P7, P11, P12

To align our NEOs’ long-term financial interests with those of our shareholders, our CEO is required to own three times his base salary and other NEOs are required to own two times their respective base salary, in shares of MAA stock or the equivalent, within three years of appointment to the position. All NEOs are in compliance with this requirement.

COMPENSATION RECOUPMENT POLICY P2, P3, P7, P11, P13 If we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, our current and former executive officers are required to own two times their respective base salary, in shares of MAA stock or the equivalent, within three years of appointment to the position. All NEOs are in compliance with this requirement.

CLAWBACK POLICY P2, P3, P7, P11, P13

If we are required to prepare and file an accounting restatement with the SEC, the Compensation Committee may require our CEO and the other NEOs to repay to MAA any portion of incentive-based compensation that was paid in the preceding three years that would not have been paid if such compensation had been determined based on the restated amounts as reflected in connection with the accounting restatement.

HOLDING PERIOD REQUIREMENTS P7, P11, P12 To further strengthen the alignment of interests between our NEOs and that of our shareholders, NEOs are required to retain ownership of at least 50% of net shares, (after the payment of taxes), acquired through equity incentive plans. NEOs must continue to retain these shares until retirement or other termination of the NEO’s employment, or until the executive is no longer designated as an NEO. All of our NEOs are in compliance with the holding period requirement.

PROHIBITION ON HEDGING AND PLEDGING SHARES P7, P11 In relation to MAA’s securities, NEOs are prohibited from purchasing financial instruments, or otherwise engaging in transactions, that hedge or offset or are designed to hedge or offset, any decrease in the market value of MAA equity securities granted as compensation that was paid in the preceding three years that would not have been paid if such compensation had been determined based on the financial results reported in the restated financial statements. MAA intends to continue to comply with any regulatory updates as required.

HOLDING PERIOD REQUIREMENTS P7, P11, P12

To further strengthen the alignment of interests between our NEOs and that of our shareholders, NEOs are required to retain ownership of at least 50% of net shares, (after the payment of taxes), acquired through equity incentive plans. NEOs must continue to retain these shares until retirement or other termination of the NEO’s employment, or until the executive is no longer designated as an NEO. All of our NEOs are in compliance with the holding period requirement.

PROHIBITION ON HEDGING AND PLEDGING SHARES P7, P11

In relation to MAA’s securities, NEOs are prohibited from purchasing financial instruments, or otherwise engaging in transactions, that hedge or offset or are designed to hedge or offset, any decrease in the market value of MAA equity securities granted as compensation

| or held directly or indirectly by NEOs. Specifically, our policy prohibits NEOs from: (i) selling a security which is not owned at the time of sale (short sale); (ii) buying or selling puts, calls, other derivative securities or other derivative securities that provide the economic equivalent of MAA securities or any opportunity to profit from a change in the value of MAA securities or engage in other hedging transactions; (iii) using securities as collateral in a margin account; and (iv) pledging securities as collateral for a loan. See page 20 for additional details on MAA’s hedging and pledging policies. EXCLUSION OF NEGATIVELY VIEWED PRACTICES In addition to the governance policies listed above, the Compensation Committee has affirmatively determined NOT to implement the below compensation practices as they are generally negatively viewed within industry best practices and the Board does not believe they are in the best interests of our shareholders at this time. | NO | Dividends or dividend equivalents on unearned performance shares |

| NO | Repricing underwater stock options |

| NO | Exchanges of underwater stock options for cash |

| NO | Backdating of stock options |

| NO | Multi-year guaranteed bonuses |

| NO | Inclusion of the value of equity awards in severance calculations |

| NO | Evergreen provisions in equity plans |

| NO | Tax “gross ups” for excess parachute payments |

| NO “Single | “Single trigger” employment or change in control agreements |

| NO | Overlapping performance metrics among annual and long-term incentive plans for NEOs |

| NO | Perquisites or personal benefits |

2023 PROXY STATEMENT | 50 |  | |

OTHER CONSIDERATIONS In addition to our compensation philosophy and objectives, shareholder feedback, input from the compensation consultant, benchmarking data, compensation risk factors and our compensation governance policies, the Compensation Committee may also take into account the following considerations, among others, when determining executive compensation packages. | ✓ | Labor market conditions P1, P4 |

| ✓ | Personal development P4, P5, P10 |

| ✓ | Quality of both internal working and reporting relationships, and engagement in collaboration and teamwork with other executive management P7 |

| ✓ | Quality of leadership and human capital development P7 |

| ✓ | Succession planning and potential to assume increased responsibilities P13 |

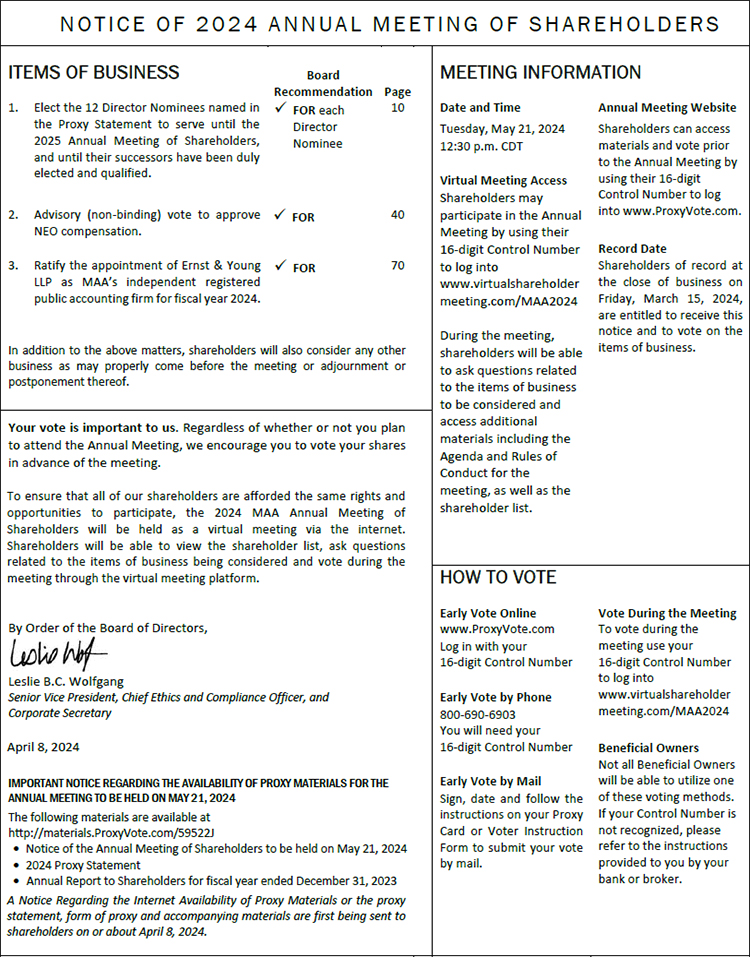

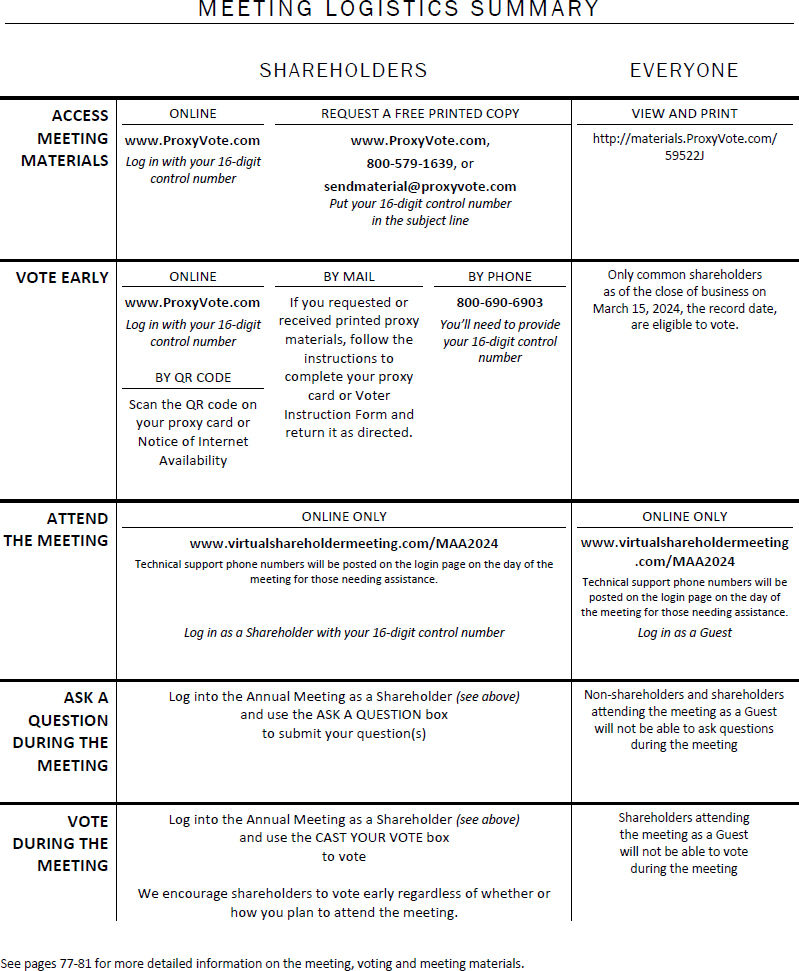

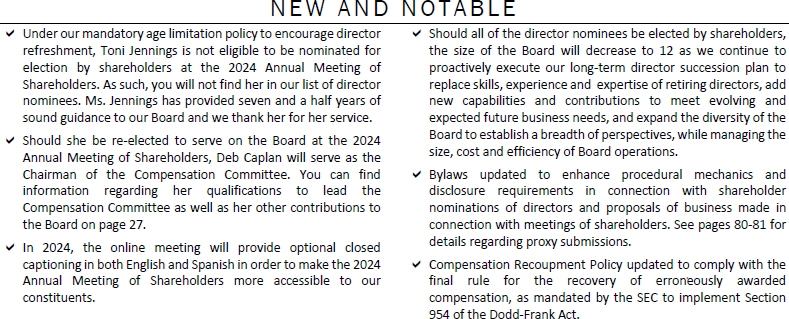

2024 PROXY STATEMENT

| 47 |

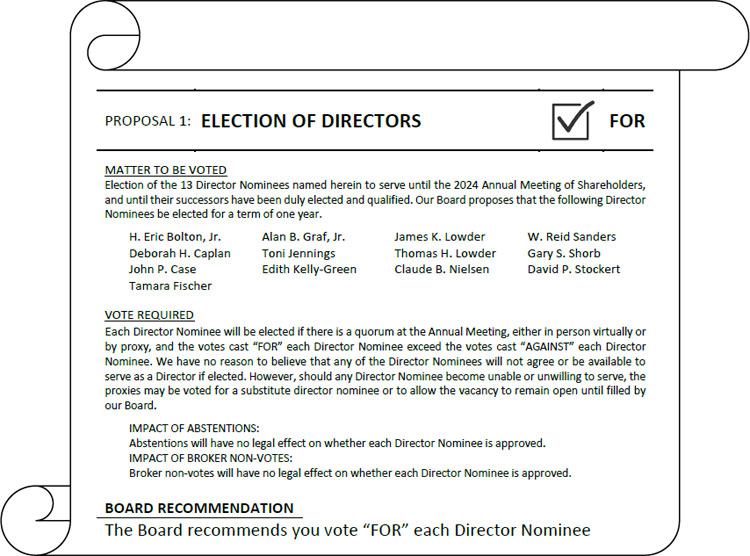

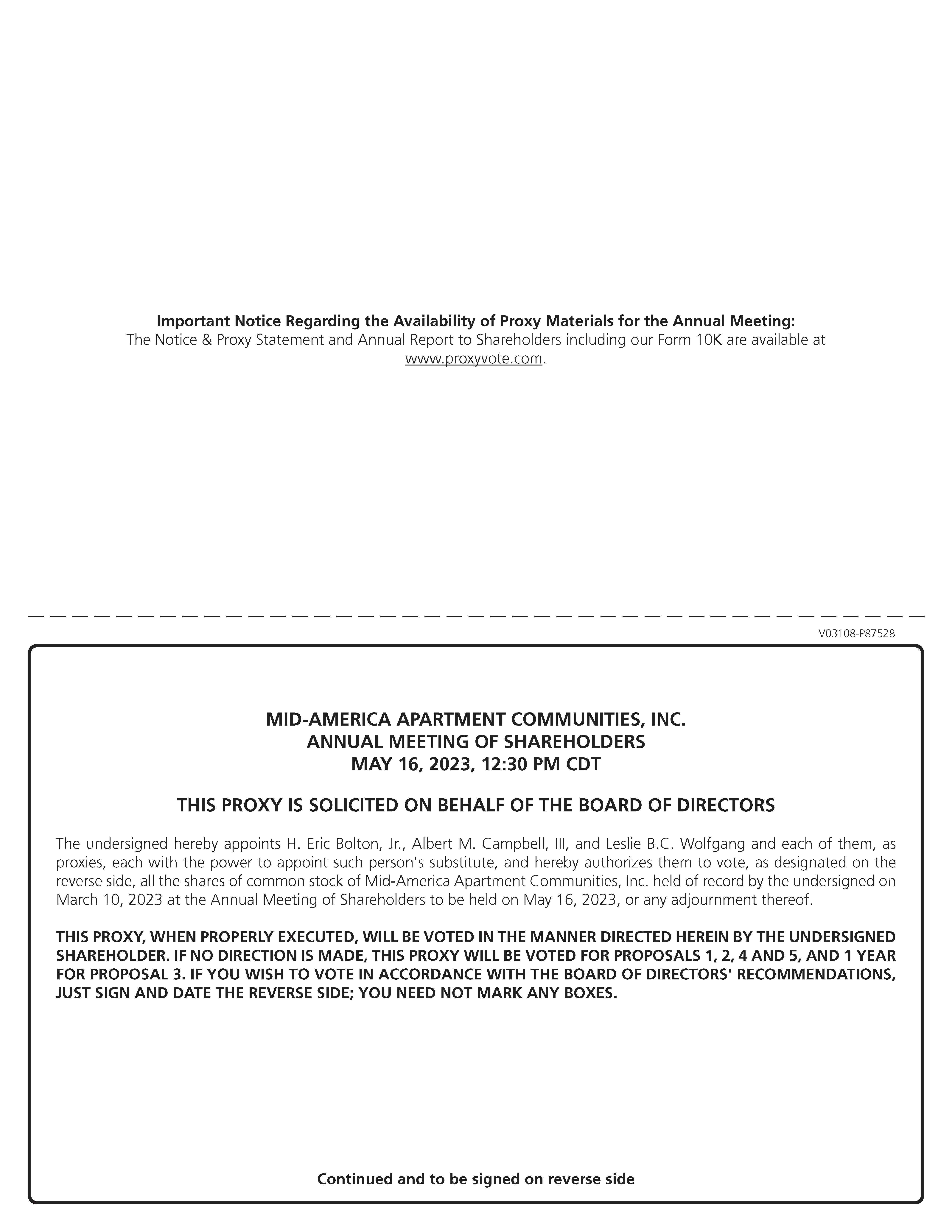

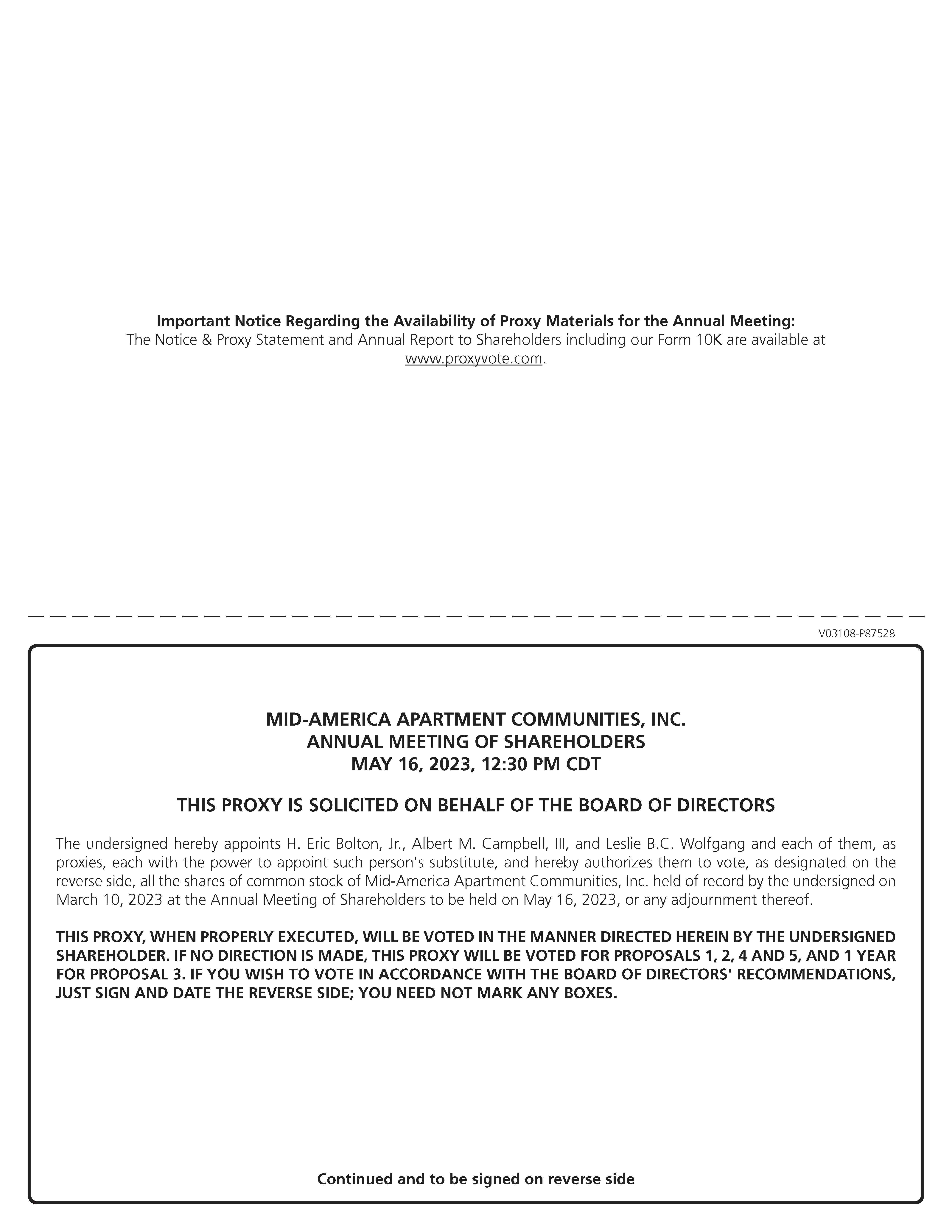

2022PROPOSAL 2: EXECUTIVE COMPENSATION

2023 PROGRAM STRUCTURE In general, theThe Compensation Committee believed that the compensation program in place for 2021 generally2022 provided an appropriate mix of cash and equity opportunities, rewarded for individual effort as well as overall company performance, balanced managing our needs for today while preparing for the future, aligned NEO’sNEOs’ interests with those of our shareholders, was aligned with peer group practices and was fair and equitable as well as financially sustainable. As such, theThe Compensation Committee did not believe that material changes in terms of the overall structure of the program or the mix of elements was warranted in setting the compensation program for 2022.

The Compensation Committee did, however, implement a new cap on the three-year TSR metric within the LTIP such that awards are capped at the target level when MAA outperforms the industry index, but has a negative return as calculated under the plan.

2023. The following pages provide an overview of the NEO compensation packages available to our NEOsprogram for 2022,2023, including the mix of elements utilized and the target opportunities available to each NEO.

2023 PROXY STATEMENT | 51 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION

20222023 NEO DIRECT COMPENSATION STRUCTURE AND OPPORTUNITIES

BASE SALARYP1, P2, P3, P4, P5, P6, P13, P14 | | | | | | | | PERCENT OF OPPORTUNITY AT TARGET | | ELEMENT | PURPOSE | FORM | PERFORMANCE METRICS | PERFORMANCE PERIOD | PERFORMANCE RANGES | | | | | | | | | | | BASE SALARY P1,P2,P3,P4,P5,P6, P13,P14 | Market-competitive fixed income reflecting individual skills, experience, performance and maturity in role to attract and retain high quality talent | CASH | FIXED | N/A | N/A | N/A | | | | | | | | | | | | | | | | | | | | | AIP P1,P2,P3,P4,P5,P6, P7,P8,P9,P10,P11, P12,P13,P14 | Performance-based awards to incent achievement of annual company earnings targets and other strategic short-term initiatives and goals Opportunities for these awards are capped at the maximum level and no awards can be earned for performance results below the threshold level Target opportunity aligns with market expectations while capped maximum opportunity rewards NEOs for outperformance without encouraging excessive risk taking | CASH or EQUITY | PERFORMANCE CORE FFO PER SHARE | 1 Year | Initial 2022 Guidance | CEO | 75% | | 2022 | Maximum | $8.10 | CFO | 50% | | | Target | $7.92 | COO | 50% | | | Threshold | $7.74 | CAO | 50% | | | | | | CIO | 50% | | | | | | | PERFORMANCE SS NOI GROWTH | 1 Year | Initial 2022 Guidance | CEO | 25% | | 2022 | Maximum | 12.0% | CFO | 25% | | | Target | 11.0% | COO | 25% | | | Threshold | 10.0% | CAO | 25% | | | | | | CIO | N/A | | | | | | | PERFORMANCE INDIVIDUAL FUNCTIONAL GOALS | 1 Year | Varies by NEO | CEO | N/A | | 2022 | (see below) | CFO | 25% | | | | | | COO | 25% | | | | | | CAO | 25% | | | | | | CIO | 50% | | | | | | | | | | | | | | | | | | | | | LTIP P1,P2,P3,P4,P5,P6, P8,P10,P11,P12,P13,P14 | Incents achievement of long-term strategic goals and aligns NEO interests with shareholder interests in long-term value creation Opportunities for these awards are capped at the maximum level and no awards can be earned for performance results below the threshold level Relative TSR is capped at target when MAA’s TSR is negative Target opportunity aligns with comparable peer performance and capped maximum opportunity allows NEOs to benefit from creating long-term shareholder value | EQUITY | PERFORMANCE RELATIVE TSR | 3 Years | Dow Jones US Real Estate Apartments Index Performance | 50% | | 2022 – 2024 | | | | | | | | Maximum | +400bps | | | | | | | Target | Index | | | | | | | | Threshold | -400bps | | | | | | | | | | | | | | PERFORMANCE FAD | 1 Year 2022 Plus 2 Year Vest Cycle | Initial 2022 Guidance | 30% | | | | Maximum | $633.8M | | | | | | Target | $621.8M | | | | | | | Threshold | $609.8M | | | | | | | | | | | | | | | | | | | | | | FIXED SERVICE-BASED SHARES | 3 Year Vest Cycle | | | 20% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CEO FUNCTIONAL GOALS

| ✓

| Mentorship and development of leadership team. |

| ✓ | Cultivate and deliver on various leadership and culture objectives to enhance teamwork, collaboration and communications across the company of MAA’s strategy and related value. |

| ✓ | Achieve financial performance results for the year that exceed expectations, protect and strengthen the balance sheet and execute on external growth and capital recycling strategies. |

| ✓ | Continue enhancement efforts to further strengthen our platform and organization, including achieving property redevelopment goals, efforts to enhance cyber risk protections, new technology rollouts and strengthening of enterprise risk management practices. |

CFO FUNCTIONAL GOALS

| ✓ | Meet various balance sheet and capital structure targets to support investment grade rating and strategy endeavors. |

| ✓ | Support MAA’s strategy with financial analysis and maintain a robust and high-quality investor relations program. |

| ✓ | Manage financial control environment, accounting close process and external audit process and execute on various continuing process improvement initiatives. |

| ✓ | Support the Internal Audit department and manage compliance with and initiatives related to tax entities in support of dividend planning. |

| ✓ | Manage overall department expense budget. |

2023 PROXY STATEMENT | 52 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION

PURPOSE AND FEATURES OPPORTUNITY AS PERCENTFORM OF SALARY AT TARGETCOMPENSATION

Cash | | | NOTES | | | | | | N/A | Market-competitive fixed income reflecting individual skills, experience, performance and maturity in role to attract and retain high quality talent. The Compensation Committee is thoughtful in setting this element because the level of base salary drives the opportunities under the performance-based elements.also impacts incentive award opportunities. As such, in determining base salary, the committee considers it both on its own and in conjunction with the other elements of compensation. |

LONG TERM INCENTIVE PLAN (LTIP)P1 ,P2, P3, P4, P5, P6, P8, P10, P11, P12, P13, P14 PURPOSE AND FEATURES

FORM OF COMPENSATION Equity | Incents achievement of long-term strategic goals, enhances retention and aligns NEO interests with shareholder interests in long-term value creation. For 2023, the target value LTIP mix for NEOs was based 50% on performance shares tied to MAA’s three-year TSR (including stock price appreciation plus dividend reinvestment) relative to an industry-specific market index, 30% on our absolute vs. planned annual Funds Available for Distribution (FAD) with any earned awards vesting over an additional two-year period, and 20% to service-based restricted shares vesting over three years. The large majority (80%) of LTIP award opportunities have performance-based vesting, with a primary focus on long-term total shareholder returns. Opportunities for performance-based awards are capped at the maximum level and no awards can be earned for performance results below the threshold level. Performance awards tied to relative TSR are capped at target when MAA’s absolute TSR is negative. The target opportunity aligns with comparable peer performance while the capped maximum opportunity provides the opportunity for NEOs to benefit from creating long-term shareholder value. | | PERFORMANCE METRICS | | | Compounded Annualized Three-Year Relative Total Shareholder Return (TSR) | | | | | | CEO | 131.25% | The Core FFO per Share performance range was based on MAA’s initial 2022 guidance to the market. | In lieu of cash, NEOs may elect to receive shares of restricted stock valued at 125% of the cash award. The shares are forfeitable, vesting annually over three years on the anniversary of the issuance date.

The Compensation Committee can modify an award up or down by up to 25% (not to exceed the capped opportunity), allowing the committee to address changes in strategic directives or awards that do not otherwise adequately reflect NEO efforts. No such adjustments were made in regards to the awards granted under the 2022 AIP.

| CFO | 65.00% | COO | 65.00% | CAO | 65.00% | CIO | 65.00% | | | | CEO | 43.75% | The SS NOI Growth performance range was based on MAA’s initial 2022 guidance to the market. | CFO | 32.50% | COO | 32.50% | CAO | 32.50% | CIO | N/A | | | | CEO | N/A | Individual functional goals include quantifiable metrics associated with the NEO’s respective areas of responsibility and are set by the Compensation Committee at the beginning of the year to align with MAA’s earnings goals and other strategic initiatives. | CFO | 32.50% | COO | 32.50% | CAO | 32.50% | CIO | 65.00% | | | | | | | | | CEO | 250.00% | In order to eliminate the impact of theprice volatility generated by the price fluctuations of any one market day, the calculations of the compounded annualized three-year TSR metric under the 2023 LTIP for MAA and the Dow Jones US Real Estate Apartments Index utilize the average of the closing stock prices in the months of December 20212022 and December 20242025 as the beginning and ending stock prices for the calculations. Because the performance periodAward funding for this metriccomponent will notbe determined following the end until Decemberof the three-year measurement period (December 31, 2024,2025) and any earned awards earned will not be realized or issued until April 2025.2026 following approval by the Compensation Committee. If MAA’s TSR as calculated under the plan is negative, awards are capped at target level. | CFO | 137.50% | COO | 137.50% | CAO | 137.50% | CIO | 100.00% | | No awards are earned for performance below threshold levels. | | | | Performance Period | 3 Years – 2023 through 2025 | | | | Performance Range | Based on performance in comparison to the performance of the Dow Jones US Real Estate Apartments Index Threshold -400 bps Target Index Maximum +400 bps | CEO | 150.00%Funds Available for Distribution (FAD) | | | The FAD performance range was based on MAA’s initial 20222023 guidance to the market. | CFO | 82.50% | COO | 82.50% | CAO | 82.50% | CIO | 60.00% | | | | Performance Period | 1 Year – 2023 plus 2 year vesting cycle | | | | Performance Range | Linked directly to initial 2023 guidance Threshold $732.7million Target $748.7million Maximum $764.7million | CEO | 100.00%Service Based Shares | | | The Compensation Committee believes that a small level of service-based shares is appropriate to encourage consistency in leadership and enhance retention and equity stakes, which it believes supports the successful achievement of our long-term strategic objectives. While the Compensation Committee considers these shares of restricted stock to be fixed (as the number of shares is set at the date of grant), it feels the length of the vesting cycle also incorporates a performance aspect as NEOs benefit from an increase in market price during the vest period. | CFO | 55.00% | COO | 55.00% | CAO | 55.00% | CIO | 40.00% |

COO FUNCTIONAL GOALS

| ✓ | Deliver SS annual revenue growth of 9.1% and hold property-level expense growth to 6.0%. |

| ✓ | Achieve effective blended lease over lease growth rate of 7.5%. |

| ✓ | Complete 6,000 unit redevelopments at targeted return on investment. |

| ✓ | Install 23,000 smart home technology packages at targeted return on investment. |

| ✓ | Do not exceed $272MM in capital projects. |

| ✓ | Do not exceed operational expense budgets. |

CAO AND GC FUNCTIONAL GOALS

| ✓ | Meet litigation and insurance costs budget. |

| ✓ | Continue work related to tracking and analyzing data. |

| ✓ | Achieve pre-set NOI and leasing performance goals within our Commercial portfolio. |

| ✓ | Manage residential assistance and collection programs within MAA and regulatory guidelines. |

| ✓ | Lead initiative to enhance participation in national, state and local industry associations. |

CIO FUNCTIONAL GOALS

| ✓ | Execute annual transaction plan (one acquisition and $300MM - $350MM in dispositions). |

| ✓ | Execution of planned predevelopment preparations, development starts, timelines and costs (at or below budget). |

| ✓ | Achieve budgeted lease-up property performance metrics at or above proformas. |

| ✓ | Manage controllable expenses within budget. |

2023 PROXY STATEMENT | 53 |  | | Performance Period | 3 year vesting cycle |

2024 PROXY STATEMENT

| 48 |

PROPOSAL 2: EXECUTIVE COMPENSATION ANNUAL INCENTIVE PLAN (AIP) The threshold, target and maximum percent of salary opportunities under the 2022 executive compensation packages are provided in the following table.

| | | CEO | CFO | Former COO | CAO | CIO | | | | | | | | | | SALARY | $880,844 | $544,846 | $558,373 | $541,637 | $415,150 | | | | | | | | | | 2022 AIP | | | | | | | | Core FFO per Share | 32.81% / 131.25% / 262.5% | 16.25% / 65% / 130% | 16.25% / 65% / 130% | 16.25% / 65% / 130% | 16.25% / 65% / 130% | | | SS NOI Growth | 10.94% / 43.75% / 87.5% | 8.13% / 32.5% / 65% | 8.13% / 32.5% / 65% | 8.13% / 32.5% / 65% | N/A | | | Individual Functional Goals | N/A | 32.50% / 32.50% / 32.50% | 32.50% / 32.50% / 32.50% | 32.50% / 32.50% / 32.50% | 65% / 65% / 65% | | Total | 43.75% / 175% / 350% | 56.88% / 130% / 235.63% | 56.88% / 130% / 235.63% | 56.88% / 130% / 235.63% | 81.25% / 130% / 211.25% | | | | | | | | | | 2022 LTIP | | | | | | | | Service | 100% | 55% | 55% | 55% | 40% | | | FAD | 37.5% / 150% / 225% | 20.63% / 82.5% / 123.75% | 20.63% / 82.5% / 123.75% | 20.63% / 82.5% / 123.75% | 15% / 60% / 90% | | | 3-YR TSR | 62.5% / 250% / 500% | 34.37% / 137.5% / 275% | 34.37% / 137.5% / 275% | 34.37% / 137.5% / 275% | 25% / 100% / 200% | | Total | 200% / 500% / 825% | 110% / 275% / 453.75% | 110% / 275% / 453.75% | 110% / 275% / 453.75% | 80% / 200% / 330% |

2022 TARGET COMPENSATIONP1, P2, P3, P4, P5, P6, P7, P8, P9, P10, P11, P12, P13, P14

PURPOSE AND FEATURES

FORM OF COMPENSATION Cash

| Performance-based awards to incent achievement of annual company earnings targets and other strategic short-term initiatives and goals. AIP award opportunities for NEOs are primarily tied to overall corporate financial performance (100% weighting for Mr. Bolton and ranging from 50% to 75% for other NEOs), with a smaller portion (ranging from 25% to 50%) tied to individual functional goals for senior executives other than Mr. Bolton. The Compensation Committee believes this mix reinforces a strong focus on company-wide performance success and collaboration as well as individual accountability. Opportunities for these awards are capped at the maximum level and no awards can be earned for performance results below the threshold level. Target opportunity aligns with market expectations while capped maximum opportunity rewards NEOs for outperformance without encouraging excessive risk taking.

The Compensation Committee can modify an award up or down by up to 25% (not to exceed the capped opportunity), allowing the committee to address changes in strategic directives or awards that do not otherwise adequately reflect NEO efforts. No such adjustments were made in regards to the awards granted under the 2023 AIP.

No awards are earned for performance under threshold levels.

| | PERFORMANCE METRICS | Core FFO per Share (75% weighting for Mr. Bolton and 50% weighting for all other NEOs) | | | Performance Period | 1 Year – 2023 | | | Performance Range | Linked directly to initial 2023 guidance Threshold $8.68 Target $8.88 Maximum $9.08 | | SS NOI Growth (25% weighting for all NEOs except Mr. Hill (0%)) | | | Performance Period | 1 Year – 2023 | | | Performance Range | Linked directly to initial 2023 guidance Threshold 5.30% Target 6.30% Maximum 7.30% | | Individual Functional Goals (25% weighting for all NEOs other than Mr. Bolton (0%) and Mr. Hill (50%)) | | | Performance Period | 1 Year – 2023 Varies by NEO. See Below. |

Individual functional goals include quantifiable metrics associated with the NEOs’ respective areas of responsibility and are set by the Compensation Committee at the beginning of the year to align with MAA’s earnings goals and other strategic initiatives. In addition to managing expenses within budget, the below represent the material goals for each NEO for 2023.

| CEO | ● Mentorship and development of executive leadership team in alignment with long-term succession plans ● Exceed market earnings result expectations and external growth and capital recycling plans ● Continue cybersecurity risk protection efforts, complete new technology roll-outs and strengthen enterprise risk management practices ● Expand corporate responsibility disclosures, improve third party scoring and complete certain corporate responsibility projects

| | CFO | ● Access capital to fund investment and refinancing plans without triggering higher risk levels or a material rise in cost of capital ● Achieve full investment grade rating ● Enhance tax planning models to support additional strategic decisions ● Meet certain milestones of accounts payable procurement redesign ● Expand key corporate responsibility disclosures and increase rating scores

|

| CAO | ● Meet certain targets related to litigation and insurance premium costs ● Attain certain commercial leasing and NOI performance targets ● Enhance representation among national, state and local apartment associations and industry advocacy groups ● Support expanded disclosures related to corporate responsibility | | CIO | ● Meet certain transaction volume targets with 1031 exchanges of dispositions ● Accomplish redevelopment milestones and start planned developments ● Meet certain unit delivery, proforma NOI yield, gross rent per unit and GOI performance targets ● Continue work towards producing Green Certified Buildings | | CSAO | ● Meet certain performance targets related to same store revenue and blended lease over lease growth, completion of interior renovations, capital expenditures and same store operating margins ● Complete identified targets of various corporate responsibility projects ● Roll-out planned artificial intelligence projects |

2024 PROXY STATEMENT

| 49 |

PROPOSAL 2: EXECUTIVE COMPENSATION The threshold, target and maximum percent of salary opportunities under the 2023 executive compensation packages are provided in the following table.

| | | CEO | CFO | CAO | CIO | CSAO | | SALARY | $916,078 | $566,640 | $563,302 | $500,007 | $366,299 | | 2023 LTIP | | | | | | | Service | 110% | 55% | 55% | 50% | 24% | | | FAD | 41.25% / 165% / 247.5% | 20.63% / 82.5% / 123.75% | 20.63% / 82.5% / 123.75% | 18.75% / 75% / 112.50% | 9% / 36% / 54% | | | 3-YR TSR | 68.75% / 275% / 550% | 34.37% / 137.5% / 275% | 34.37% / 137.5% / 275% | 31.25% / 125% / 250% | 15% / 60% / 120% | | Total | 220% / 550% / 907.5% | 110% / 275% / 453.75% | 110% / 275% / 453.75% | 100% / 250% / 412.50% | 48% / 120% / 198% | | 2023 AIP | | | | | | | Core FFO per Share | 32.81% / 131.25% / 262.5% | 16.25% / 65% / 130% | 16.25% / 65% / 130% | 16.25% / 65% / 130% | 11.25% / 45% / 90% | | | SS NOI Growth | 10.94% / 43.75% / 87.5% | 8.13% / 32.5% / 65% | 8.13% / 32.5% / 65% | N/A | 5.63% / 22.5% / 45% | | | Individual Functional Goals (1) | N/A | 32.50% / 32.50% / 40.63% | 32.50% / 32.50% / 40.63% | 65% / 65% / 81.25% | 22.5% / 22.5% / 28.13% | | Total | 43.75% / 175% / 350% | 56.88% / 130% / 235.63% | 56.88% / 130% / 235.63% | 81.25% / 130% / 211.25% | 39.83% / 90% / 163.13% |

| (1) | Under the 2023 AIP, if NEOs complete 100% of their individual goals, they earn the target level percent of salary opportunity. The capped maximum amount would only come into play if the Compensation Committee determined to utilize the up to +/-25% modifier. |

2023 TARGET COMPENSATION P1, P2, P3, P4, P5, P6, P7, P8, P9, P10, P11, P12, P13, P14 In setting compensation plan opportunities for 2022,2023, the Compensation Committee noted the expanding roles of responsibility in regards to Messrs. Hill and Argo and that there had been no material changes in responsibilities of the executive officers, except for Messrs. Bolton, Campbell and DelPriore, and Hill, andfor whom the Compensation Committee determined no salary increases beyond the 3%4% cost of living increases given to the associate base at large were warranted. Due to promotions and the level of expanded responsibilities in 20222023 for both Mr. DelPriore and Mr. Hill, including responsibility for additional functional areas related to our operations and technology advancements, the Compensation Committee awarded Mr. DelPrioreHill a 2%16% base salary merit increase to salary beyond the 3%4% cost of living increase to reflectincrease. The Compensation Committee also determined that Mr. Argo’s expanded areas of responsibility in 2023, resulting from his appointmentpromotion in October 2022, including asset and revenue management as CAO, and awarded Mr. Hillwell as margin expansion, warranted a 12%16% base salary merit increase to salary beyond the 3%4% cost of living increase to reflect his appointment as CIO in late 2021.increase. ExpressedGenerally, based on the compensation consultant’s peer benchmark review, the Compensation Committee determined that no changes to 2022 AIP award opportunities, expressed as a percentagepercentages of base salary, no change was made towere necessary for Messrs. Bolton, Campbell, Hill and DelPriore as they were at or above the CEO’s50th percentile. To recognize Mr. Argo’s recent promotion and other NEOs’assumption of additional responsibilities in late 2022, the Compensation Committee set his target AIP award opportunity.opportunity at 90% of base salary for 2023.

In determining the target opportunity for the 20222023 LTIP, the Compensation Committee noted that the compensation consultant benchmark data indicated Mr. Bolton’s 2021 target opportunity was below the 25th percentileMessrs. Bolton and increased the long-term target opportunity to between the 25th percentile and the 50th percentile. The Compensation Committee also noted that Mr. Hill’s 2021 long-term target opportunity was wellHill were both below the 50th percentile market values and determined to increase their percent of salary target opportunities to 550% and 250%, respectively, in line withorder to maintain a competitive range for their respective positions. To recognize Mr. Argo’s promotion and assumption of additional responsibilities in October 2022, the Compensation Committee set his promotion to CIO, increased his long-term2023 target LTIP award opportunity to approximately the 50th percentile market valueat 120% of base salary. Expressed as percentages of base salary, 2023 LTIP award opportunities for Messrs. Campbell and DelPriore were unchanged from the 2021 Pearl Meyer study.2022 levels. The corresponding target dollar values for each NEO based on the 20222023 compensation packages outlined above are provided below. | | 2022 | 2022 AIP TARGET | | | TOTAL | | | BASE | CORE FFO | SS NOI | FUNCTIONAL | | 2022 LTIP TARGET (1) | COMPENSATION | | | SALARY | PER SHARE | GROWTH | GOALS | TOTAL | SERVICE | FAD | 3-YR TSR | TOTAL | TARGET | | Bolton CEO | $880,844 | $1,156,108 | $385,369 | N/A | $1,541,477 | $880,844 | $1,321,266 | $2,202,110 | $4,404,220 | $6,826,541 | | Campbell CFO | $544,846 | $ 354,150 | $177,075 | $177,075 | $ 708,300 | $299,666 | $ 449,498 | $ 749,163 | $1,498,327 | $2,751,473 | Grimes Former COO | $558,373 | $ 362,942 | $181,471 | $181,471 | $ 725,884 | $307,105 | $ 460,658 | $ 767,763 | $1,535,526 | $2,819,783 | | DelPriore GC | $541,637 | $ 352,064 | $176,032 | $176,032 | $ 704,128 | $297,900 | $ 446,851 | $ 744,751 | $1,489,502 | $2,735,267 | | Hill CIO | $415,150 | $ 269,848 | N/A | $269,848 | $ 539,696 | $166,060 | $ 249,090 | $ 415,150 | $ 830,300 | $1,785,146 |

| | 2023 | 2023 AIP TARGET | | | TOTAL | | | BASE | CORE FFO | SS NOI | FUNCTIONAL | | 2023 LTIP TARGET (1) | COMPENSATION | | | SALARY | PER SHARE | GROWTH | GOALS | TOTAL | SERVICE | FAD | 3-YR TSR | TOTAL | TARGET | | Bolton CEO | $916,078 | $1,202,352 | $400,784 | N/A | $1,603,136 | $1,007,686 | $1,511,529 | $2,519,215 | $5,038,430 | $7,557,644 | | Campbell CFO | $566,640 | $ 368,316 | $184,158 | $184,158 | $ 736,632 | $ 311,652 | $ 467,478 | $ 779,130 | $1,558,260 | $2,861,532 | | DelPriore CAO | $563,302 | $ 366,146 | $183,073 | $183,073 | $ 732,292 | $ 309,816 | $ 464,724 | $ 774,540 | $1,549,080 | $2,844,674 | | Hill CIO | $500,007 | $ 325,005 | N/A | $325,005 | $ 650,010 | $ 250,004 | $ 375,005 | $ 625,009 | $1,250,018 | $2,400,035 | | Argo CSAO | $366,299 | $ 164,835 | $82,417 | $82,417 | $ 329,669 | $ 87,912 | $ 131,868 | $ 219,779 | $ 439,559 | $1,135,527 |

| (1) | To the extent earned, awards under the 20222023 LTIP are issued in shares of restricted stock that then vest over various time periods. The number of target shares of restricted stock are based on the closing stock price of $227.39$157.74 on January 4, 2022,2023, the grant date for the 20222023 LTIP. |

20232024 PROXY STATEMENT

| 54 |  | 50 |

PROPOSAL 2: EXECUTIVE COMPENSATION

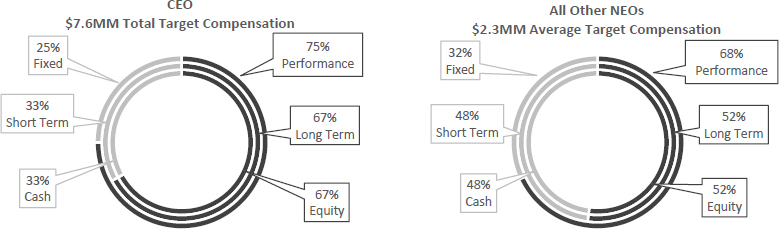

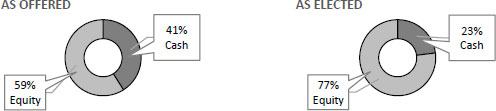

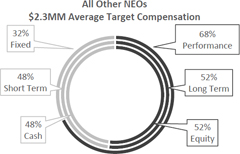

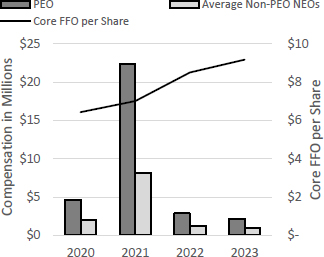

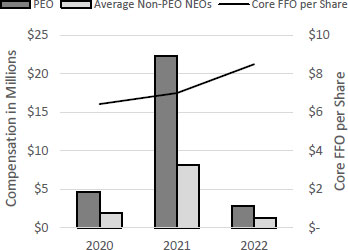

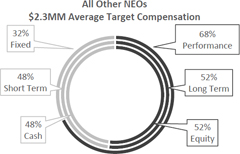

The 20222023 target compensation opportunities outlined aboveon the prior page result in the following percentage breakouts between variable (or performance based)performance-based) and fixed compensation, equity and cash compensation, and long-term and short-term compensation.compensation, showing that the majority of our NEOs’ compensation is performance-based, long-term in nature and in the form of equity to align our leadership with the long-term interests of shareholders.

20222023 COMPENSATION CAPS P2, P3

The following schedule provides the maximum direct compensation opportunities, or caps, for over-performance from target under the 20222023 NEO compensation program.packages. The values presented in the below table fundamentallyinherently incorporate any use of the AIP 25%+25% discretionary modifier under the 2023 AIP, as use of the modifier is capped at the AIP maximum opportunities.

| | | | | | | | | | | | | | 2022 | 2022 AIP MAXIMUM | | | TOTAL | | | BASE | CORE FFO | SS NOI | FUNCTIONAL | | 2022 LTIP MAXIMUM | COMPENSATION | | | SALARY | PER SHARE | GROWTH | GOALS | TOTAL | SERVICE | FAD | 3-YR TSR | TOTAL | MAXIMUM | | Bolton CEO | $880,844 | $2,312,216 | $770,739 | N/A | $3,082,955 | $880,844 | $1,981,899 | $4,404,220 | $7,266,963 | $11,230,762 | | Campbell CFO | $544,846 | $ 708,300 | $354,150 | $221,371 | $1,283,821 | $299,665 | $ 674,247 | $1,498,327 | $2,472,239 | $ 4,300,906 | Grimes Former COO | $558,373 | $ 725,885 | $362,942 | $226,867 | $1,315,694 | $307,105 | $ 690,987 | $1,535,526 | $2,533,617 | $ 4,407,684 | | DelPriore GC | $541,637 | $ 704,128 | $352,064 | $220,067 | $1,276,259 | $297,900 | $ 670,276 | $1,489,502 | $2,457,678 | $ 4,275,574 | | Hill CIO | $415,150 | $ 539,695 | N/A | $337,309 | $ 877,004 | $166,060 | $ 373,635 | $ 830,300 | $1,369,995 | $ 2,662,149 |

2022 NEO COMPENSATION

| | | | | | | | | | | | | | 2023 | 2023 AIP MAXIMUM | | | TOTAL | | | BASE | CORE FFO | SS NOI | FUNCTIONAL | | 2023 LTIP MAXIMUM | COMPENSATION | | | SALARY | PER SHARE | GROWTH | GOALS | TOTAL | SERVICE | FAD | 3-YR TSR | TOTAL | MAXIMUM | | Bolton CEO | $916,078 | $2,404,705 | $801,568 | N/A | $3,206,273 | $1,007,686 | $2,267,293 | $5,038,429 | $8,313,408 | $12,435,759 | | Campbell CFO | $566,640 | $ 736,632 | $368,316 | $230,226 | $1,335,174 | $ 311,652 | $ 701,217 | $1,558,260 | $2,571,129 | $ 4,472,943 | | DelPriore GC | $563,302 | $ 732,293 | $366,146 | $228,870 | $1,327,309 | $ 309,816 | $ 697,086 | $1,549,081 | $2,555,983 | $ 4,446,594 | | Hill CIO | $500,007 | $ 650,009 | N/A | $406,256 | $1,056,265 | $ 250,004 | $ 562,508 | $1,250,018 | $2,062,530 | $ 3,618,802 | | Argo CSAO | $366,299 | $ 329,669 | $164,835 | $103,040 | $ 597,544 | $ 87,912 | $ 197,801 | $ 439,559 | $ 725,272 | $ 1,689,115 |

2024 PROXY STATEMENT

| 51 |

2022 MAA PERFORMANCEPROPOSAL 2: EXECUTIVE COMPENSATION

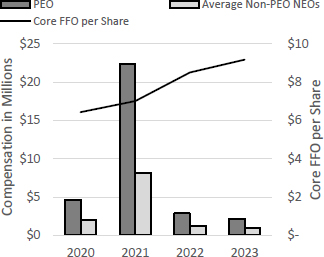

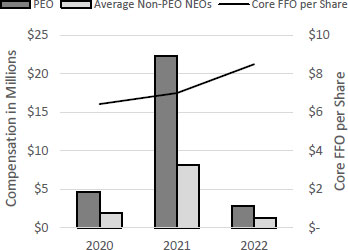

2023 NEO COMPENSATION REALIZED

2023 MAA PERFORMANCE The Compensation Committee believes it is important that executive compensation reflects the overall performance and health of the company including both annual financial measures and long-term shareholder return and has, therefore, tied a substantial majority of our CEO’s and each of the other NEO’s compensation to performance measures. Below is a review of our performance during 2022.2023. You can find more details in our Annual Report on Form 10-K filed with the SEC on February 14, 2023.9, 2024. OVERALL MAA FINANCIAL PERFORMANCE

| | Initial 2022 Forecast2023 Guidance | Actual 20222023 | | | SS Property Revenue Growth | 8%5.25% - 10%7.25% | 13.5%6.2% | | | SS Operating Expense Growth | 5%5.15% - 6%7.15% | 7.6%6.5% | | | SS NOI Growth | 10%5.30% - 12%7.30% | 17.1%6.0% | See pages 94-9583 for a reconciliation of NOI to netNet income available for MAA common shareholders, and an expanded discussion of the components of NOI. | | Earnings per Common Share –Diluted | $4.875.97 - $5.23$6.37 | $5.484.71 | | | Core FFO per Share –Diluted | $7.748.88 - $8.10$9.28 | $8.509.17 | See pages 94-9583 for a reconciliation of Core FFO under the plan document to netNet income available for MAA common shareholders and an expanded discussion of the components of Core FFO. |

2023 PROXY STATEMENT | 55 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATIONRETURNS TO SHAREHOLDERS

RETURNS TO SHAREHOLDERS

COMMON DIVIDENDS | ✓ Declared our 116120th consecutive common dividend in December 20222023 (paid in January 2023)2024) ✓ Returned approximately $539.6$651.7 million to common shareholders in the form of cash dividends during 20222023 ✓ Annual common dividend rate increased 14%12% from $4.10 in 2021 to $4.675 in 2022 to $5.60 in 2023 | ANNUAL DIVIDEND PAID PER COMMON SHARE |

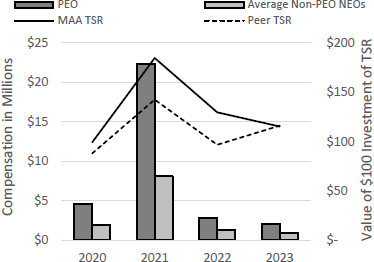

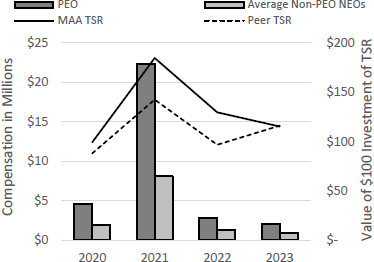

| TSR | We use TSR as a measure of the financial value we create for shareholders as TSR combines share price appreciation and the reinvestment of dividends to provide an annualized percentage of the total performance of shares of stock over time. In both absolute and relative standards, we have consistently created significant value for our shareholders.

| ONE YEAR TSR | WhileIn 2023, MAA underperformed both a sector index and the apartment sector of the REIT industry underperformed the broader market S&P 500 Index in terms of 2022 TSR performance, MAA’s 2022 TSR results outperformed an apartment sector index.Index.

| MAA | -29.80%-11.1%

| | Dow Jones US Real Estate Apartments Index | -32.08%7.1% | | S&P 500 Index | -18.10%26.3% | FIVE YEAR CUMULATIVE TSR | The chart to the right shows how a $100 investment in MAA common stock on December 31, 20172018 would have grown to $182.93$164.44 on December 31, 2022,2023, with dividends reinvested quarterly. The chart also compares the total shareholder return on our common stock to the same investment in the S&P 500 Index and the Dow Jones US Real Estate Apartment Index. |

|

| 2024 PROXY STATEMENT | 52 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION COMPENSATION INCENTIVE PLAN PERFORMANCE METRIC RESULTS

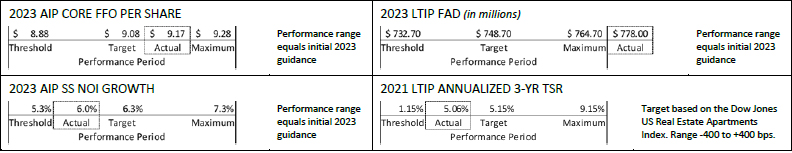

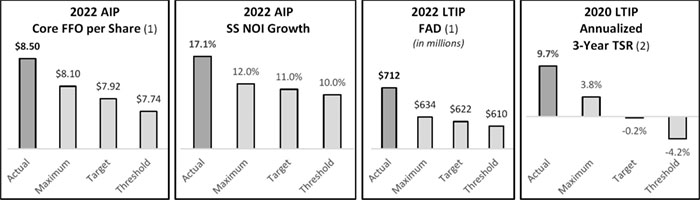

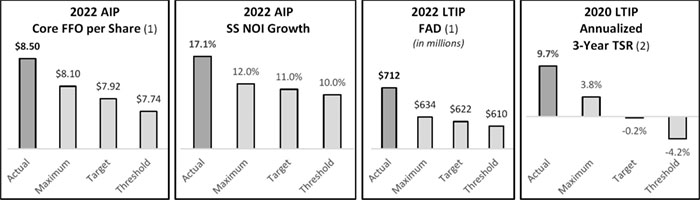

The below charts compare the actual performance results of the financial and market metrics in our executive incentive plans that had performance periods ending on December 31, 2022,2023, to the performance award range established in the respective plan. Each of the metrics outperformed the maximum performance level.

| 2023 AIP CORE FFO PER SHARE | | | $8.88 | | $9.08 | $9.17 | $9.28 | Performance range equals initial 2023 guidance | | | Threshold | | Target | Actual | Maximum | | | | | | | | | | 2023 AIP SS NOI GROWTH | | | 5.3% | 6.0% | 6.3% | | 7.3% | Performance range equals initial 2023 guidance | | | Threshold | Actual | Target | | Maximum | | | | | | | | | | 2023 LTIP FAD (in millions) | | | $732.7 | | $748.7 | | $764.7 | $778.0 | Performance range equals initial 2023 guidance | | | Threshold | | Target | | Maximum | Actual | | | | | | | | | | 2021 LTIP RELATIVE ANNUALIZED 3-YR TSR (1) | | | 1.15% | 5.06% | 5.15% | | 9.15% | Target based on the Dow Jones US Real Estate Apartments Index, threshold at -400 bps and maximum at +400 bps. | | | Threshold | Actual | Target | | Maximum |

| (1) | See pages 94-95 for a reconciliation of Core FFO per Share as calculated under the 2022 AIP and FAD as calculated under the 2022 LTIP to net income available for MAA common shareholders, and an expanded discussion of the components of Core FFO per Share and FAD. |

| (2) | In order toTo eliminate the impact of the volatility generated by the price fluctuations of any one market day,day’s price volatility, the calculations for the three-year TSR for MAA and the Dow Jones US Real Estate Apartments Index under the 20202021 LTIP utilize the average of the closing stock prices in the months of December 20192020 and December 20222023 as the beginning and ending stock prices for the calculations. |

2023 PROXY STATEMENT | 56 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION

2022See pages 83 for a reconciliation of Core FFO per Share (as calculated under the 2023 AIP) and FAD (as calculated under the 2023 LTIP) to Net income available for MAA common shareholders, and an expanded discussion of the components of Core FFO per Share and FAD.

2023 DIRECT NEO COMPENSATION REALIZED

In March 2023,2024, the Compensation Committee reviewed the performance under the compensation incentive plans for our executive officers to determine awards earned thereunder. The following discussion reviews the total compensation realized by our CEO and other NEOs for 2022.2023. 20222023 FINANCIAL METRICS

The Compensation Committee noted (as outlined inthat the results of the performance financial metrics varied, (see the Compensation Incentive Plan Performance Metric Results section on page 56)53), thatnoting Core FFO per Share results were between target and maximum, SS NOI Growth was between threshold and target and FAD was above the performance of all ofmaximum level. The Compensation Committee determined no adjustments allowable under the financial metrics in2023 AIP were warranted and awarded the incentive plans with performance periods ending on December 31, 2022 resulted in payoutscorresponding opportunities to actual results for Core FFO per Share and SS NOI Growth. Because FAD was above the maximum level, the award was capped at their respectivethe maximum award levels.opportunity. MARKET METRIC

The performance period for the 20202021 LTIP TSR metric concluded on December 31, 2022.2023. Under the 20202021 LTIP, awards for the market metric, a three-year compounded annualized relative total shareholder return, are dependent on a range of results based on the comparable performance of the SNL U.S. REIT Multifamily Index with target set at the index performance, threshold set at 400 basis points below the performance of the index and maximum set at 400 basis points above the performance of the index. As the SNL U.S. REIT Multifamily Index ceased to be published during the performance period, under the provisions of the 20202021 LTIP, the Compensation Committee replaced the index was replaced with the Dow Jones US Real Estate Apartments Index (which(the composition of which is materially comprised of the same companies assimilar to the previous index), by the Compensation Committee.. At theits March 20232024 meeting, the Compensation Committee reviewed the results of the market metric under the 20202021 LTIP, noting that MAA’s three-year compound annualized TSR, of 9.7%, as calculated under the 20202021 LTIP, outperformed the three-year compound annualized TSR of 5.06% was above the index calculated in the same manner,benchmark of -0.2% by approximately 990 basis points,4.67%, resulting in a performance above the maximum levelan award between target and payout at the cap for the metric.maximum. 2022 FUNCTIONAL GOALS

| 2024 PROXY STATEMENT | 53 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION 2023 FUNCTIONAL GOALS The Compensation Committee also reviewed the achievement of individual functional goals as previously set in the beginning of 20222023 for each of the NEOs under the 20222023 AIP. The committee noted that, in alignment with our overall performance for the 2022 Individual Functionalyear, some goals related to our financial guidance for 2023 were highly correlatedeither not met or were not fully met. The Compensation Committee also noted that each NEO’s goals related to driving strong overall company performance and as such, given MAA’s strong performance in 2022, there was also strong performance across the goals.corporate sustainability were materially met. The committee discussed the performance of the EVPs with our CEO and the performance of the CEO amongst the committee members. Following these discussions, the Compensation Committee made the following determinations in regards to the level of completion of each of the NEO’s functional goals under the 20222023 AIP.

ALBERT M. CAMPBELL III In discussing Mr. Campbell’s goal achievements for 2023, the Compensation Committee noted that balance sheet and capital structure goals were materially achieved, as were enhancements to tax planning modelling, and internal and external auditing procedures. The Compensation Committee also noted that corporate sustainability goals related to enhancing materiality surveys and key annual disclosures were materially completed. The Compensation Committee then noted that some goals related to investor relations and enhancements to account payable procedures and efficiencies made good progress during the year but were not as materially complete as other goals. Taking into account the level of completion of all of Mr. Campbell’s functional goals, the Compensation Committee determined Mr. Campbell achieved 93.8% of his functional goals under the 2023 AIP. ALBERT M. CAMPBELL III

In discussing Mr. Campbell’s goal achievements for 2022, the Compensation Committee noted the continued strengthening of our balance sheet to pursue a full A investment grade rating and capacity to support external growth, favorable renewals of our credit facility and commercial paper program, management of debt maturities and execution of a forward equity contract. The committee also discussed the continuing development of our investor relations program while noting the company’s performance well above the guidance provided to the market. The committee noted the level of completion of various automation and efficiency projects, including those related to the working relationship with our external auditors. The committee discussed the success of various federal, state and local tax projects, projection of dividend needs and management of real estate taxes. Taking into account the level of completion of all of Mr. Campbell’s functional goals, the Compensation Committee determined Mr. Campbell achieved 93% of his functional goals under the 2022ROBERT J. DELPRIORE In discussing Mr. DelPriore’s goal achievements for 2023, the Compensation Committee noted that goals related to certain expense controls, regulatory reviews, NOI and leasing performance of our commercial division, corporate sustainability disclosures, and enhanced involvement with industry associations and legislative procedures were materially completed. The Compensation Committee then noted that while goals related to support of property legal needs progressed during the year, they were not materially achieved. Taking into account the level of completion of all of Mr. DelPriore’s functional goals, the Compensation Committee determined Mr. DelPriore achieved 96.6% of his functional goals under the 2023 AIP. A. BRADLEY HILL In discussing Mr. Hill’s goal achievements for 2023, the Compensation Committee noted that goals surrounding pre-development work for planned projects, timely delivery of development units, meeting proforma NOI yields, certain financial lease-up property goals and expense controls were materially met. The Compensation Committee also noted that corporate sustainability goals related to New Building Green Certifications were met. The Compensation Committee then noted that goals related to development starts and dispositions were materially not met as strategic decisions were made to delay certain transactional projects. Taking into account the level of completion of all of Mr. Hill’s functional goals and the change in strategy which moved previously expected transactional activity to 2024, the Compensation Committee determined Mr. Hill achieved 79.6% of his functional goals under the 2023 AIP.

THOMAS L. GRIMES, JR.

In discussing Mr. Grimes’ goal achievements for 2022, the Compensation Committee noted the actual performance of rent growth, renovation initiatives, and Smart Home installations against performance measures previously set for the year. The Compensation Committee also noted that capital expenditures were aligned with the goal set, but operating expenses fell above the top end of the range previously set. Taking into account the level of completion of all of Mr. Grimes’ functional goals, the Compensation Committee determined Mr. Grimes achieved 80% of his functional goals under the 2022 AIP.

| | | ROBERT J. DELPRIORE

In discussing Mr. DelPriore’s goal achievements for 2022, the Compensation Committee noted the actual performance of general liability litigation spend and insurance premiums against ranges previously set by the committee, the successful implementation of a data analytics project, Commercial NOI and leasing performance against targets previously set, and actions to expand MAA’s involvement in federal, state and local industry associations and industry advocacy groups. Taking into account the level of completion of all of Mr. DelPriore’s functional goals, the Compensation Committee determined Mr. DelPriore achieved 95% of his functional goals under the 2022 AIP.

A. BRADLEY HILL

In discussing Mr. Hill’s goal achievements for 2022, the Compensation Committee noted execution of transactional plans exceeding or meeting the range previously set in Mr. Hill’s functional goals. The Compensation Committee also noted the level of completion of various development goals related to planned starts, timeline to deliver units, budget expectations and pre-development work. The Compensation Committee considered actual performance of lease-up gross rent per unit and GOI against proforma. Taking into account the level of completion of all of Mr. Hill’s functional goals, the Compensation Committee determined Mr. Hill achieved 92% of his functional goals under the 2022 AIP.

|

TIMOTHY ARGO In discussing Mr. Argo’s goal achievements for 2023, the Compensation Committee noted that most of the performance result goals related to asset management targets were met, but certain revenue management and operating margin goals tied to our initial guidance for 2023 were either not met or did not perform as well as expected. The Compensation Committee also noted that corporate sustainability goals related to energy efficiency and our rollout of Smart Home technology were materially completed. Taking into account the level of completion of all of Mr. Argo’s functional goals, the Compensation Committee determined Mr. Argo achieved 80.0% of his functional goals under the 2023 AIP.

20232024 PROXY STATEMENT | 5754 |   | |

PROPOSAL 2: EXECUTIVE COMPENSATION

As a result of the previous determinations, the compensation awarded to the CEO by the Board upon recommendation from the Compensation Committee, and the compensation awarded to the other NEOs by the Compensation Committee, is provided below. DIRECT COMPENSATION REALIZED IN 20222023

| | | | | | | | | TOTAL | | TOTALS AS AWARDED | | | 2022 | 2022 AIP (1) | | DIRECT | | | SHARES OF | | | SALARY | CORE FFO | SS NOI | FUNCTIONAL | 2022 LTIP (2) | 2020 LTIP (2) | COMPENSATION | | | RESTRICTED | | | RECEIVED | PER SHARE | GROWTH | GOALS | SERVICE | FAD | 3-YR TSR | REALIZED (3) | TARGET | CASH | STOCK | | Bolton CEO | $879,857 | $2,312,216 | $770,739 | N/A | $608,022 | $1,368,168 | $2,838,536 | $8,777,538 | $6,196,469 | $3,962,812 | 30,669 | | Campbell CFO | $544,236 | $ 708,300 | $354,150 | $ 164,680 | $206,756 | $ 465,475 | $1,287,004 | $3,730,601 | $2,715,392 | $1,771,366 | 12,480 | Grimes Former COO | $557,748 | $ 725,885 | $362,942 | $ 145,177 | $211,937 | $ 476,936 | $1,391,030 | $3,799,654 | $2,782,805 | $1,791,752 | 12,790 | | DelPriore GC | $540,645 | $ 704,128 | $352,064 | $ 167,230 | $205,657 | $ 462,650 | $1,255,135 | $3,687,508 | $2,685,895 | $1,764,067 | 12,252 | | Hill CIO | $413,067 | $ 539,695 | N/A | $ 248,260 | $114,603 | $ 257,935 | $ 468,458 | $2,042,017 | $1,627,084 | $1,201,022 | 5,357 |

| | | | | | | | | TOTAL | | TOTALS AS AWARDED | | | 2023 | 2023 AIP | | DIRECT | | | SHARES OF | | | SALARY | CORE FFO | SS NOI | FUNCTIONAL | 2023 LTIP (1) | 2021 LTIP (1) | COMPENSATION | | | RESTRICTED | | | RECEIVED | PER SHARE | GROWTH | GOALS | SERVICE | FAD | 3-YR TSR | REALIZED (2) | TARGET | CASH | STOCK | | Bolton CEO | $914,723 | $1,743,411 | $310,615 | N/A | $ 858,930 | $1,932,594 | $2,186,589 | $ 7,946,862 | $6,855,704 | $2,968,749 | 37,023 | | Campbell CFO | $565,802 | $ 534,058 | $142,731 | $ 172,740 | $ 265,559 | $ 597,675 | $ 875,066 | $ 3,153,630 | $2,809,745 | $1,415,331 | 12,928 | | DelPriore CAO | $562,469 | $ 530,912 | $141,890 | $ 176,904 | $ 264,079 | $ 594,179 | $ 853,418 | $ 3,123,851 | $2,779,421 | $1,412,175 | 12,730 | | Hill CIO | $496,743 | $ 471,257 | N/A | $ 258,704 | $ 212,985 | $ 479,484 | $ 315,443 | $ 2,234,616 | $2,037,256 | $1,226,704 | 7,496 | | Argo CSAO | $375,692 | $ 239,010 | $ 63,879 | $ 65,926 | $ 74,894 | $ 168,478 | $ 141,586 | $ 1,129,466 | $1,033,471 | $ 744,507 | 2,863 |

| (1) | Awards earned under the 2022 AIP are shown in dollars to reflect each NEO’s election to receive 100% of the award in cash. |

| (2) | Represents shares of restricted stock granted or earned in 2022,2023, valued at the closing stock price of $156.99$134.46 on December 31, 2022. See page 65 for more details.29, 2023. |

| (3)(2) | Total direct compensation realized includes salary received during 2022,2023, short-term bonuses earned under the 20222023 AIP, the value (based on the December 29, 2023 closing stock price of $134.46) of service shares and awards earned in relation to the FAD metric (for which the performance period ended on December 31, 2022)2023) under the 20222023 LTIP, and awards earned under the 20202021 LTIP for the 3-Year TSR metric (for which the performance period ended on December 31, 2022).2023) based on the closing stock price on December 29, 2023 of $134.46. |

The direct compensation realized in 20222023 represents the percent of target opportunities as indicated in the table below. | | | 2022 AIP | | | | | | | CORE FFO | SS NOI | FUNCTIONAL | 2022 LTIP (1) | 2020 LTIP (1) | | | | SALARY | PER SHARE | GROWTH | GOALS | SERVICE (2) | FAD (2) | 3-YR TSR (3) | TOTAL | | Bolton CEO | 100% | 200% | 200% | N/A | 69% | 104% | 181% | 129% | | Campbell CFO | 100% | 200% | 200% | 93% | 69% | 104% | 180% | 136% | Grimes Former COO | 100% | 200% | 200% | 80% | 69% | 104% | 180% | 135% | | DelPriore CAO | 100% | 200% | 200% | 95% | 69% | 104% | 180% | 135% | | Hill CIO | 100% | 200% | N/A | 92% | 69% | 104% | 182% | 114% |

| | | 2023 AIP | | | | | | | CORE FFO | SS NOI | FUNCTIONAL | 2023 LTIP (2) | 2021 LTIP (2) | | | | SALARY (1) | PER SHARE | GROWTH | GOALS | SERVICE (3) | FAD (3) | 3-YR TSR (4) | TOTAL | | Bolton CEO | 100% | 145% | 78% | N/A | 85% | 128% | 120% | 116% | | Campbell CFO | 100% | 145% | 78% | 94% | 85% | 128% | 120% | 112% | | DelPriore CAO | 100% | 145% | 78% | 97% | 85% | 128% | 120% | 112% | | Hill CIO | 99% | 145% | N/A | 80% | 85% | 128% | 120% | 110% | | Argo CSAO | 103% | 145% | 78% | 80% | 85% | 128% | 120% | 109% |

| (1) | (1)Mr. Argo’s salary received in 2023 includes back pay from the end of 2022, representing the correct timing of a promotion. |

| (2) | The compensation in these columns was awarded in shares of restricted stock that remain at risk of forfeiture until vested, dependent upon the NEO’s continued employment in good standing with MAA through each vest date. |

| (2)(3) | The percent of target values reflectreflects the drop in stock price from $227.39$157.74 on the January 4, 2023 grant date (the target value) to $156.99$134.46 at the close of business on December 31, 2022.29, 2023. The value of these shares will continue to increase or decrease in relation to the returns achieved for shareholders. |

| (3)(4) | The percent of target values reflectreflects the increase in stock price from $130.30$122.71 on the January 4, 2021 grant date (the target value) to $156.99$134.46 at the close of business on December 31, 2022.29, 2023. The value of these shares will continue to increase or decrease in relation to the returns achieved for shareholders. |

OTHER COMPENSATION ELEMENTS

BENEFITS

BENEFITS In addition to their direct compensation, the NEOs also participate in benefit programs, which are generally available to all of our associates, dependent upon the specific eligibility requirements related to each. In general, benefits are designed to provide a safety net of protection against the financial catastrophes that can result from illness, disability or death, and to provide a reasonable level of retirement income based on years of service. 401(K) PLAN

Our CEO and other NEOs are eligible to participate in our 401(K) Plan, a qualified retirement plan made available to all of our eligible associates that allows participants to make pre-tax elective deferral contributions as a percentage of their compensation as well as catch-up contributions in any year in which the participant will be at least age 50 by the end of the year. For 2022,2023, MAA made matching contributions under the 401(K) Plan of 100% of a participant’s contribution on the first 3% of their compensation and 50% of a participant’s contribution on the next 2% of their compensation. Participants may defer up to 75% of their compensation under the 401(K) Plan until they reach the limitation imposed by Section 401(a) of the Code, for the given year. Under the terms of the 401(K) Plan, benefits generally start on or after the date the participant reaches the age of 65. Under the law, participants must begin receiving benefits by April 1st following the later of the calendar year in which a participant reaches the age of 70½,72 (73 if thea participant reached the age of 70½ before January 1, 2020,72 after December 31, 2022,) or 72, if the participant does not reach the age of 70½ before January 1, 2020, or stops working for MAA.retires. Additional information and NEO participation during 20222023 can be found on page 68.63. 20232024 PROXY STATEMENT | 5855 |   | |

PROPOSAL 2: EXECUTIVE COMPENSATION

EXECUTIVE DEFERRED COMPENSATION PLAN Our CEO and other NEOs are eligible to participate in the Executive Deferred Compensation Plan, which is a supplemental nonqualified deferred compensation plan made available to all executives to enable them to accumulate additional retirement benefits beyond the limitations on participant contributions placed on the 401(K) Plan. MAA, at its discretion, may make matching contributions in accordance with the matching contribution formula in the 401(K) Plan. As such, in 2022,2023, MAA made matching contributions under the Executive Deferred Compensation Plan of 100% of a participant’s contribution on the first 3% of their compensation and 50% of a participant’s contribution on the next 2% of their compensation. The matching contributions were made only on compensation that was in excess of the limitation imposed by Section 401(a) of the Code on the 401(K) Plan that would have been eligible for the match. Participants may defer up to 50% of their compensation and 90% of their annual bonus. In accordance with the Executive Deferred Compensation Plan, distributions for balances prior to 2016 are made in five equal annual installments beginning on the first day following the sixth full month occurring after the earliest of death, disability, or separation from service. Balances from 2016 and forward will be distributed in compliance with the participant’s previous elections for the specific contributions in the form of either a lump-sum payment or substantially equal annual installments amortized over a period not to exceed ten years beginning on the later of January 1st or six months and a day after the participant’s separation from service. Notwithstanding the foregoing, in the case of a participant who becomes entitled to receive benefits on account of disability, the balances from 2016 and forward will be paid in a lump sum on or after the 15th of the first month following determination of disability. Unlike contributions made in the 401(K) Plan, the deferred compensation amounts contributed by Messrs. Bolton, Campbell, Grimes, DelPriore and Hill,our NEOs and any resultant matches by MAA, are considered general assets of the company and are subject to claims of MAA’s creditors. In 2016, MAA transferred the assets of the Executive Deferred Compensation Plan to an irrevocable rabbi trust to offer some security to the participants. While assets in the rabbi trust are still subject to creditors’ claims in a corporate bankruptcy, they cannot be accessed by MAA for any purpose other than to pay participant benefits under the Executive Deferred Compensation Plan. Additional information and NEO participation during 20222023 can be found on page 69.64. EMPLOYMENT AGREEMENTS Mr. Bolton is our only NEO with an employment agreement. The material terms of his employment agreement and amounts payable under that agreement are described on pages 70-71.65-66. CHANGE IN CONTROL AGREEMENTS Messrs. Campbell, Grimes, DelPriore, Hill and HillArgo have change in control agreements. These change in control agreements and the amounts payable under the agreements are described on pages 70-71.

RETIREMENT AND TRANSITION AGREEMENT65-66.

During 2022, MAA made certain organizational changes to better align our structure with the execution of our long-term strategy and to meet the future needs of MAA. As a result, changing role responsibilities resulted in the elimination of the then COO position held by Mr. Grimes. Mr. Grimes served as EVP and COO through December 31, 2022, at which point MAA transitioned to a new operational leadership structure and Mr. Grimes’ employment terminated without cause. MAA entered into a Retirement and Transition Agreement with Mr. Grimes that provided for a payout of severance in the amount of $558,373, unused vacation in the amount of $6,443 and health and welfare payments totaling $18,074. Pursuant to the terms of the Second Amended and Restated 2013 Stock Incentive Plan and the applicable award agreements, the vesting restrictions lapsed on 100% of Mr. Grimes’ unvested shares of restricted stock immediately after his last day of employment, which was December 31, 2022. In addition, a prorated portion of any outstanding performance metrics for which the performance period had not yet ended as of December 31, 2022, shall remain eligible to be awarded based upon actual MAA performance at the end of the applicable performance period and the amount of time Mr. Grimes was employed during the performance period.

2023 PROXY STATEMENT | 59 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION

TAX AND ACCOUNTING IMPLICATIONS OF COMPENSATION Section 162(m) of the Code historically limited the tax deductibility of annual compensation paid by a publicly held corporation to its “covered employees,” which Section 162(m) defines as the corporation’s principal executive officer or any of its three other most highly compensated executive officers (other than its principal financial officer), to $1 million, unless the compensation qualified as performance-based compensation under Section 162(m). Under the Tax Cuts and Jobs Act of 2017, this “performance-based” exception was eliminated, and the definition of “covered employees” generally was expanded to cover all named executive officers, including the principal financial officer. These new rules generally apply to taxable years beginning after December 31, 2017, but do not apply to compensation provided pursuant to a written, binding contract in effect on November 2, 2017 that is not modified in any material respect after that date. The American Rescue Plan Act of 2021 amended Section 162(m) of the Code to expand the covered employees subject to its compensation deduction limitation. Pursuant to the amendment, five additional employees will be covered each year, and such employees need not be executive officers of the company. In addition, any employee identified as the CEO, CFO, or the next three highest-paid employees in any applicable year would remain a covered employee indefinitely. The new rule would apply to taxable years beginning after December 31, 2026. Since MAA qualifies as a REIT under the Code and is generally not subject to federal income taxes, we believe the payment of compensation that may exceed the deduction limit under Section 162(m) would not have a material adverse consequence to us, provided we continue to distribute 100% of our taxable income. If we make compensation payments subject to Section 162(m) limitations on deductibility, we may be required to make additional distributions to shareholders to comply with our REIT distribution requirements and eliminate our U.S. federal income tax liability or, alternatively, a larger portion of shareholder distributions that would otherwise have been treated as a return of capital may be subject to federal income tax treatment as dividend income. Although we are mindful of the limits imposed by Section 162(m), even if it is determined that Section 162(m) applies or may apply to certain of our compensation packages, we have reserved, and will continue to reserve, the right to structure our compensation packages and awards in a manner that may exceed the limitation on deduction imposed by Section 162(m). CONCLUSION

| 2024 PROXY STATEMENT | 56 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION CONCLUSION The Compensation Committee believes that our executive leadership is a key component of our ability to successfully execute on our strategy to deliver sustainable and growing value to our shareholders. As such, designing an executive compensation packageprogram that attracts, retains and motivates individuals with the right skills and abilities to execute our strategy while also balancing cost to MAA and its shareholders, preserves the ability to maintain compensation levels over the long-term and minimize risks associated with incentive and compensation plans is critically important. The Compensation Committee believes it has historically maintained compensation for our executive officers at levels that reflect the talent and success of the individuals being compensated, is sufficiently comparable to our industry peers to allow us to retain our key personnel at levels which are appropriate and sustainable for MAA, and, with the majority of the compensation opportunities being directly tied to performance, appropriately focuses and motivates executive endeavors to fully realize our long-term strategy. The Compensation Committee believes the idea of creating ownership in MAA helps align management’s interests with the interests of shareholders and will continue to develop, analyze and review its methods for aligning executive management’s long-term compensation with the benefits generated for shareholders. The Compensation Committee has no pre-determined timeline for implementing new or ongoing long-term incentive plans. New plans are reviewed, discussed and implemented as the Compensation Committee feels it is necessary or appropriate as a measure to incent, retain and reward our executive management.

2023 PROXY STATEMENT | 60 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION

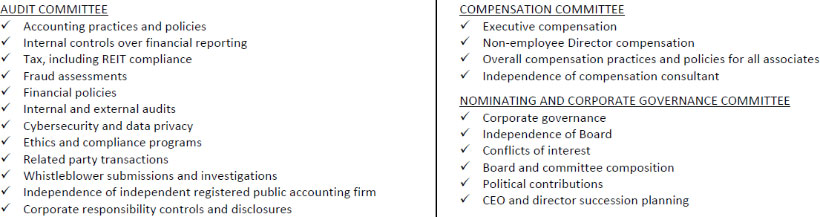

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of MAA reviewed and discussed with management the information contained in the Compensation Discussion and Analysis section of this Proxy Statement and recommended to the Board that the Compensation Discussion and Analysis section be included in this Proxy Statement and our Annual Report on Form 10-K. COMPENSATION COMMITTEE: | COMPENSATION COMMITTEE: | | | Philip W. Norwood, CHAIRMAN | | | Toni Jennings | | | Thomas H. Lowder | | | Toni Jennings, CHAIRMAN Deborah H. Caplan John P. Case Thomas H. Lowder Claude B. Nielsen

| 2024 PROXY STATEMENT | 57 |  | |

2023 PROXY STATEMENT | 61 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION EXECUTIVE COMPENSATION TABLES |

EXECUTIVE COMPENSATION TABLES

SUMMARY COMPENSATION TABLE The below table sets forth information regarding compensation earned by our NEOs. As required by Item 402 of Regulation S-K under the Exchange Act, the values for stock awards represent the full grant date fair value of such awards determined in accordance with FASB ASC Topic 718 and appear in aggregate in the year of the grant. These amounts represent the total expense that MAA expects to recognize over time related to the award as of the grant date; however, due to performance requirements, the length of certain performance periods, vesting schedules and continued employment requirements, the amounts may or may not represent the actual value of stock realized by the NEOs, if at all, or the timing of stock acquired by the NEOs. For information on actual shares issued to NEOs related to the fair value amounts provided in the below table, see the footnotes to this table and the Outstanding Equity Awards at Fiscal Year-End table found on page 65.61. Mr. HillArgo was determined to meet the requirements to be considered an NEO of MAA in December 2021.2023. As a newer designated NEO, under the disclosure requirements of the SEC, the tables in this Executive Compensation Tables section of this Proxy Statement only contain compensation information for Mr. HillArgo for fiscal year 2021,2023, the year in which he was designated an NEO, and 2022.NEO. Name and

Principal Position | Year | Salary

($)

(1) | Bonus

($)

(2) | Stock

Awards

($)

(3) | Non-Equity

Incentive Plan

Compensation

($)

(4) | All Other

Compensation

($)

(5) | Total

($) | | H. Eric Bolton, Jr. | 2022 | $ 879,857 | $ 600 | $ 4,123,473 | $ 3,082,955 | $ 282,132 | $ 8,369,017 | | CEO | 2021 | $ 854,543 | $ 700 | $ 3,742,806 | $ 2,993,160 | $ 76,446 | $ 7,667,655 | | | 2020 | $ 837,481 | $ 500 | $ 2,852,176 | $ 907,875 | $ 127,280 | $ 4,725,312 | | Albert M. Campbell, III | 2022 | $ 544,236 | $ 600 | $ 1,402,816 | $ 1,227,130 | $ 129,183 | $ 3,303,965 | | EVP and CFO | 2021 | $ 528,578 | $ 700 | $ 1,498,016 | $ 1,196,907 | $ 41,624 | $ 3,265,825 | | | 2020 | $ 518,024 | $ 500 | $ 1,293,569 | $ 445,087 | $ 60,160 | $ 2,317,340 | | Thomas L. Grimes, Jr. | 2022 | $ 557,748 | $ 500 | $ 1,437,644 | $ 1,234,004 | $ 715,544 | $ 3,945,440 | | Former EVP and COO (6) | 2021 | $ 541,701 | $ 700 | $ 1,535,207 | $ 1,233,299 | $ 44,239 | $ 3,355,146 | | | 2020 | $ 530,885 | $ 500 | $ 1,325,684 | $ 496,668 | $ 67,909 | $ 2,421,646 | | Robert J. DelPriore | 2022 | $ 540,645 | $ 400 | $ 1,394,553 | $ 1,223,422 | $ 126,006 | $ 3,285,026 | | EVP and CAO | 2021 | $ 515,456 | $ 600 | $ 1,460,827 | $ 1,167,142 | $ 40,465 | $ 3,184,490 | | | 2020 | $ 505,164 | $ 400 | $ 1,261,455 | $ 432,470 | $ 58,689 | $ 2,258,178 | | A. Bradley Hill | 2022 | $ 413,067 | $ 600 | $ 777,372 | $ 787,955 | $ 63,966 | $ 2,042,960 | | EVP and CIO | 2021 | $ 351,811 | $ 700 | $ 540,081 | $ 692,218 | $ 30,222 | $ 1,615,032 |

| | | | | | | | | | | | | | | Non-Equity | | | | | | | | | | | | | | | | | | | | Stock | | | Incentive Plan | | | All Other | | | | | | | | | | | Salary | | | Bonus | | | Awards | | | Compensation | | | Compensation | | | | | | Name and | | | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | Total | | | Principal Position | | | Year | | | (1) | | | (2) | | | (3) | | | (4) | | | (5) | | | ($) | | | H. Eric Bolton, Jr. | | | 2023 | | | $ | 914,723 | | | $ | 500 | | | $ | 4,728,342 | | | $ | 2,054,026 | | | $ | 318,174 | | | $ | 8,015,765 | | | CEO | | | 2022 | | | $ | 879,857 | | | $ | 600 | | | $ | 4,123,473 | | | $ | 3,082,955 | | | $ | 282,132 | | | $ | 8,369,017 | | | | | | 2021 | | | $ | 854,543 | | | $ | 700 | | | $ | 3,742,806 | | | $ | 2,993,160 | | | $ | 76,446 | | | $ | 7,667,655 | | | Albert M. Campbell, III | | | 2023 | | | $ | 565,802 | | | $ | 500 | | | $ | 1,462,358 | | | $ | 849,529 | | | $ | 128,926 | | | $ | 3,007,115 | | | EVP and CFO | | | 2022 | | | $ | 544,236 | | | $ | 600 | | | $ | 1,402,816 | | | $ | 1,227,130 | | | $ | 129,183 | | | $ | 3,303,965 | | | | | | 2021 | | | $ | 528,578 | | | $ | 700 | | | $ | 1,498,016 | | | $ | 1,196,907 | | | $ | 41,624 | | | $ | 3,265,825 | | | Robert J. DelPriore | | | 2023 | | | $ | 562,469 | | | $ | 500 | | | $ | 1,453,743 | | | $ | 849,706 | | | $ | 127,785 | | | $ | 2,994,203 | | | EVP and CAO | | | 2022 | | | $ | 540,645 | | | $ | 400 | | | $ | 1,394,553 | | | $ | 1,223,422 | | | $ | 126,006 | | | $ | 3,285,026 | | | | | | 2021 | | | $ | 515,456 | | | $ | 600 | | | $ | 1,460,827 | | | $ | 1,167,142 | | | $ | 40,465 | | | $ | 3,184,490 | | | A. Bradley Hill | | | 2023 | | | $ | 496,743 | | | $ | 500 | | | $ | 1,173,086 | | | $ | 729,960 | | | $ | 77,904 | | | $ | 2,478,193 | | | EVP and CIO | | | 2022 | | | $ | 413,067 | | | $ | 600 | | | $ | 777,372 | | | $ | 787,955 | | | $ | 63,966 | | | $ | 2,042,960 | | | | | | 2021 | | | $ | 351,811 | | | $ | 700 | | | $ | 540,081 | | | $ | 692,218 | | | $ | 30,222 | | | $ | 1,615,032 | | | Timothy Argo | | | 2023 | | | $ | 375,692 | | | $ | 500 | | | $ | 412,506 | | | $ | 368,815 | | | $ | 40,813 | | | $ | 1,198,326 | | | EVP and CSAO | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Represents salary paid during the calendar year indicated. These values may differ slightly from the base salary amounts set by the Compensation Committee of the Board as a result of the actual number of pay periods which fall in any given calendar year. |

| (2) | Reflects an annual holiday bonus paid to all associates based on length of service and, based on health insurance selected by the NEO, a wellness incentive available to all associates within a certain health insurance option offered by MAA. |

| (3) | Represents the aggregate grant date fair value based upon probable outcome in accordance with FASB ASC Topic 718 in the year of the grant. For a complete description of the assumptions made in determining the FASB ASC Topic 718 valuation, refer to the note titled Stock BasedStock-Based Compensation to the consolidated financial statements included in our Annual Report on Form 10-K for the indicated fiscal year. Additional details for each grant can be found in the table to the right. For purposes of the table, shares issued in 20232024 are classified as Shares Earned as of December 31, 20222023 as long as the performance period for the resultant share issuance was completed by December 31, 2022.2023. In addition, the Maximum Opportunity amounts provided in the table represent the total cap amount in each plan, as applicable, by the Compensation Committee and will not necessarily tie to the FASB ASC Topic 718 amount reflected in the Summary Compensation Table. |

| a) | Due to Mr. Grimes’ termination of employment at the end of business on December 31, 2022, his Maximum Future Share Opportunity represents only 1/3rd of the remaining 2022 LTIP TSR performance shares and 2/3rd of the remaining 2021 LTIP TSR performance shares to represent the amount of time he served as COO during the respective performance periods. |

| | | | Maximum Opportunity as Granted | | | Shares Earned | | | Maximum Future | | | | | | | | | Number | | | as of | | | Share | | | Year | | | In Dollars | | | Of Shares | | | 12/31/2023 | | | Opportunity | | | 2023 LTIP | | | | | | | | | | | | | | | Bolton | | | $ | 8,313,408 | | | | 52,702 | | | | 20,761 | | | | 31,941 | | | Campbell | | | $ | 2,571,129 | | | | 16,298 | | | | 6,420 | | | | 9,878 | | | DelPriore | | | $ | 2,555,983 | | | | 16,203 | | | | 6,383 | | | | 9,820 | | | Hill | | | $ | 2,062,529 | | | | 13,074 | | | | 5,150 | | | | 7,924 | | | Argo | | | $ | 725,272 | | | | 4,596 | | | | 1,810 | | | | 2,786 | | 2022 LTIP

| | | | | | | | | | | | | | | | | | | Bolton | | | $ | 7,266,963 | | | | 31,956 | | | | 12,588 | | | | 19,368 | | | Campbell | | | $ | 2,472,238 | | | | 10,871 | | | | 4,282 | | | | 6,589 | | | DelPriore | | | $ | 2,457,677 | | | | 10,807 | | | | 4,257 | | | | 6,550 | | | Hill | | | $ | 1,369,995 | | | | 6,024 | | | | 2,373 | | | | 3,651 | | 2021 LTIP

| | | | | | | | | | | | | | | | | | | Bolton | | | $ | 5,997,006 | | | | 48,870 | | | | 35,513 | | | | - | | | Campbell | | | $ | 2,400,233 | | | | 19,558 | | | | 14,212 | | | | - | | | DelPriore | | | $ | 2,340,647 | | | | 19,074 | | | | 13,861 | | | | - | | | Hill | | | $ | 865,358 | | | | 7,050 | | | | 5,123 | | | | - | |

| | Maximum Opportunity as Granted | Shares Earned | Maximum Future | | | | Number | as of | Share | | Year | In Dollars | Of Shares | 12/31/2022 | Opportunity | | 2022 LTIP | | | | | | Bolton | $7,266,963 | 31,956 | 12,588 | 19,368 | | Campbell | $2,472,238 | 10,871 | 4,282 | 6,589 | | Grimes (a) | $2,533,617 | 11,140 | 4,388 | 2,250 | | DelPriore | $2,457,677 | 10,807 | 4,257 | 6,550 | | Hill | $1,369,995 | 6,024 | 2,373 | 3,651 | | 2021 LTIP | | | | | | Bolton | $5,997,006 | 48,870 | 19,251 | 29,619 | | Campbell | $2,400,233 | 19,558 | 7,704 | 11,854 | | Grimes (a) | $2,459,824 | 20,044 | 7,896 | 8,098 | | DelPriore | $2,340,647 | 19,074 | 7,514 | 11,560 | | Hill | $ 865,358 | 7,050 | 2,777 | 4,273 | | 2020 LTIP | | | | | | Bolton | $4,401,705 | 33,780 | 33,780 | - | | Campbell | $1,996,629 | 15,322 | 15,322 | - | | Grimes | $2,046,198 | 15,702 | 15,702 | - | | DelPriore | $1,947,061 | 14,941 | 14,941 | - |

20232024 PROXY STATEMENT | 6258 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION | (4) | Represents cash bonuses paid under the AIPs. |

| (5) | Represents matching contributions made by MAA to the Executive Deferred Compensation Plan and 401(K) Plan as detailed in the table below. |

| | Deferred | | | | | Comp Plan | 401(K) Plan | Total | | 2022 | | | | | Bolton | $ 131,955 | $ 12,200 | $ 144,155 | | Campbell | $ 59,759 | $ 12,200 | $ 71,959 | | Grimes | $ 61,808 | $ 12,200 | $ 74,008 | | DelPriore | $ 58,346 | $ 12,200 | $ 70,546 | | Hill | $ 29,972 | $ 12,200 | $ 42,172 | | 2021 | | | | | Bolton | $ 64,846 | $ 11,600 | $ 76,446 | | Campbell | $ 30,024 | $ 11,600 | $ 41,624 | | Grimes | $ 32,639 | $ 11,600 | $ 44,239 | | DelPriore | $ 28,865 | $ 11,600 | $ 40,465 | | Hill | $ 18,622 | $ 11,600 | $ 30,222 | | 2020 | | | | | Bolton | $ 115,880 | $ 11,400 | $ 127,280 | | Campbell | $ 48,760 | $ 11,400 | $ 60,160 | | Grimes | $ 56,509 | $ 11,400 | $ 67,909 | | DelPriore | $ 47,289 | $ 11,400 | $ 58,689 |

| | | | Deferred | | | | | | | | | | | | Comp Plan | | | 401(K) Plan | | | Total | | | 2023 | | | | | | | | | | | | | | | Bolton | | | $ | 152,814 | | | $ | 13,200 | | | $ | 166,014 | | | Campbell | | | $ | 60,737 | | | $ | 13,200 | | | $ | 73,937 | | | DelPriore | | | $ | 60,422 | | | $ | 13,200 | | | $ | 73,622 | | | Hill | | | $ | 36,634 | | | $ | 13,200 | | | $ | 49,834 | | | Argo | | | $ | 16,062 | | | $ | 14,052 | | | $ | 30,114 | | | 2022 | | | | | | | | | | | | | | | Bolton | | | $ | 131,955 | | | $ | 12,200 | | | $ | 144,155 | | | Campbell | | | $ | 59,759 | | | $ | 12,200 | | | $ | 71,959 | | | DelPriore | | | $ | 58,346 | | | $ | 12,200 | | | $ | 70,546 | | | Hill | | | $ | 29,972 | | | $ | 12,200 | | | $ | 42,172 | | | 2021 | | | | | | | | | | | | | | | Bolton | | | $ | 64,846 | | | $ | 11,600 | | | $ | 76,446 | | | Campbell | | | $ | 30,024 | | | $ | 11,600 | | | $ | 41,624 | | | DelPriore | | | $ | 28,865 | | | $ | 11,600 | | | $ | 40,465 | | | Hill | | | $ | 18,622 | | | $ | 11,600 | | | $ | 30,222 | |

For Mr. Grimes’ All Other Compensation also represents $582,890 paid pursuant to an agreement related to his termination, representing a $558,373 severance payment, $6,443 unused vacation payment and $18,074 related to health and welfare benefits.

The remaining balances in this column represent dividends paid on unvested shares of restricted stock that were not included in the grant date fair value amounts (determined in accordance with FASB ASC Topic 718) in the Stock Awards column.

| (6) | Mr. Grimes served as our EVP and COO through the close of business on December 31, 2022, after which he was no longer employed by MAA. |

20232024 PROXY STATEMENT | 6359 |  | |

PROPOSAL 2: EXECUTIVE COMPENSATION GRANTS OF PLAN BASEDPLAN-BASED AWARDS The following table summarizes grants of plan-based awards made to our NEOs during 2022.2023. | | | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (1) | Estimated Future Payouts

Under Equity Incentive

Plan Awards (2) | Grant Date

Fair Value of